Carbon credits are a market-based mechanism that aims to reduce the emission of greenhouse gases. Carbon credits (CC) are a crucial element in the global effort to combat climate change. They create a market-based approach to controlling pollution by providing financial incentives for reducing emissions. The companies or entities that emit less than their allotted amount can sell their excess credits to others that exceed their limits. The goal of CC is to create a financial incentive for companies to reduce their emissions by providing a way for them to offset their emissions by purchasing credits. Therefore, they represent a tradable certificate or permit that allows the holder to emit a certain amount of carbon dioxide (CO₂) or other greenhouse gases (GHGs).

Carbon offsetting is a carbon trading mechanism that enables entities e.g. governments or business entities to compensate for (i.e. “offset”) their greenhouse gas emissions by investing in projects that reduce, avoid, or remove emissions elsewhere. When a company wants to offset its green house emissions, it can purchase carbon credits from other companies or organizations that have significantly reduced their greenhouse gas emissions to the atmosphere. The number of credits needed depends on the company’s emissions level. For instance, if a company emits 100 metric tons of carbon dioxide per year, it would need to purchase 100 carbon credits to offset its emissions.

Carbon offsetting is a carbon trading mechanism that enables entities e.g. governments or business entities to compensate for (i.e. “offset”) their greenhouse gas emissions by investing in projects that reduce, avoid, or remove emissions elsewhere. When a company wants to offset its green house emissions, it can purchase carbon credits from other companies or organizations that have significantly reduced their greenhouse gas emissions to the atmosphere. The number of credits needed depends on the company’s emissions level. For instance, if a company emits 100 metric tons of carbon dioxide per year, it would need to purchase 100 carbon credits to offset its emissions.

For those purchasing the carbon credits, the price can vary depending on the market supply and demand dynamics. Their cost is typically set by the project that generates the credits, which is usually a renewable energy or energy efficiency project. The project is then certified by a third-party organization, such as the Verified Carbon Standard or the Gold Standard, which ensures that the credits are real, valid, genuine and verifiable.

Types of Carbon Credits

Voluntary Emission Reductions (VERs): These are credits generated by projects that reduce or remove GHGs outside of a regulatory scheme. The individuals and companies purchase VERs voluntarily.

Certified Emission Reductions (CERs): These are credits generated by projects that comply with regulatory standards, such as those under the Clean Development Mechanism (CDM) of the Kyoto Protocol.

Carbon Credit Markets

:max_bytes(150000):strip_icc()/Carbon-markets-7972128_final-3e1deab003104299afd27a4de367ef4b.png)

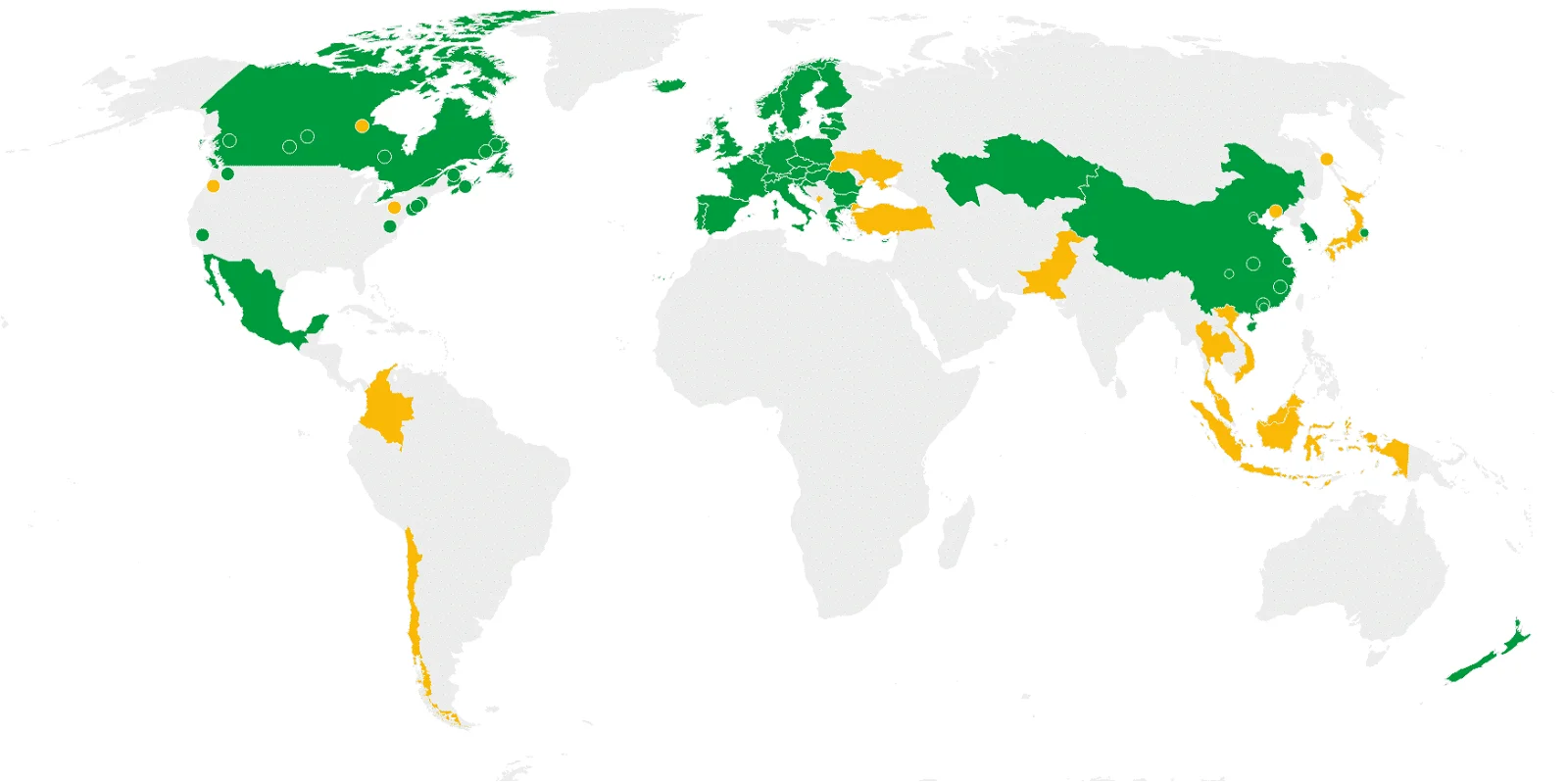

Globally, there is a wide range of sources of supply and demand as well as the trading frameworks that drive offset and credit markets. As of 2023, approximately 83 carbon pricing programs were in place or scheduled to be created across the world. Some of these programs involve carbon taxes, but most of them carbon emission trading programs, or other types of market-oriented program involving carbon offsets and credits.

Compliance Markets: The compliance carbon credit prices are largely driven by government policy. Government strategy will dictate maximum emission limits (otherwise known as allowances, or credits). These are established by national, regional, or international regulations to achieve specific emissions reduction targets. Examples include the European Union Emission Trading Scheme (EU ETS) and the California Cap-and-Trade Program (CCTP). According to carboncredits.com, the value of global carbon credit market reached ~$850 billion in 2021, 164% increase from 2020.

Voluntary Carbon Markets: They functions outside of the compliance market. These operate outside of regulatory frameworks and allow businesses, governments, and individuals to purchase credits to offset their emissions voluntarily. The key players include the Verified Carbon Standard (VCS) and the Gold Standard. Those that participate in this market are not required to reduce their emissions, it’s entirely voluntary! Therefore, many companies participate because they feel it is their socially responsibility to do so, because of the shareholder pressure, or because it’s a good PR action.

Ideally, the VCM gives companies, non-profit organizations, governments or individuals the opportunity to buy and sell carbon offset credits. As defined in the above section, a carbon offset is an instrument that represents the reduction of one metric tonne of carbon dioxide or Green House Gas (GHG) emissions. To put this in perspective, to capture one (1) ton of CO2 emissions you would have to grow approximately 50 trees for one-year.

Furthermore, instead of a cap-and-trade system, the VCM uses a project-based system in which there is no finite supply of allowances. In the VCM more and more carbon credits can be created through the development of environmentally viable projects. The companies or organisations can buy these credits to offset unavoidable emissions in order to reach their targets.

Voluntary vs. Compliance Market

|

Voluntary Market |

Compliance Market |

|

| Exchanged Commodity | Carbon offsets. Facilitated by the project-based system | Allowances. Facilitated by the cap-and-trade system. |

| How is the market regulated? | Functions outside of the compliance market. | National, regional or international carbon reduction regimes E.g. Kyoto Protocol, California Carbon Market |

| What is the price? | Voluntary credits tend to be cheaper because they cannot be used in compliance markets.2 Several factors impact the price such as project type, project size, location, co-benefits, and vintage. | Compliance credits tend to be more expensive because they are driven by regulatory obligations.3 |

| Who can purchase credits? | Businesses, governments, NGOs, and individuals | Companies and governments have adopted emission limits established by the United Nations Convention on Climate change |

| Where do credits trade? | Currently no centralized voluntary carbon credit market. Project developers can sell credits directly to buyers, through a broker or an exchange, or sell to a retailer who then resells to a buyer. | Companies that surpass their emission targets can sell their surplus credits to those looking to offset emissions. Credits can be sold under the Kyoto Protocols emissions trading scheme. |

Environmental Projects in VCM

The environmentally viable projects in VCM range from small community-based activities such as clean-cookstoves, to large industrial-style projects such as high-volume hydro plants and commercial reforestation. In most cases, small scale community-based projects typically produce smaller volumes of carbon credits but at the same time generate more additional socio-economic as well as environmental co-benefits. A co-benefit is anything from saving all the endangered animals from extinction to improving local water quality or creating sustainable jobs. The project developers often align co-benefits with the UN’s Sustainable Development Goals (SDGs) as these co-benefits can help to increase the overall value of a credit.

How are carbon credits priced?

- Size of a project: Larger projects that produce higher volumes of carbon credits often have a lower price. On the flip side, smaller projects are often more expensive to implement but produce fewer carbon credits.

- Location of offset: Where does the environmental project take place? The locations where there is conflict and higher risk may make the project more expensive.

- Vintage: What year did the emission reduction occur? Older projects are typically priced lower.

- Quality: The standard in which the project was certified can affect the price.

- Co-benefits: A co-benefit is any positive impact that is produced by the project above and beyond GHG emissions. For instance, if a project creates jobs for local communities or increases biodiversity, these are types of co-benefits.

Market for trading the Credits?

Though there is no centralized voluntary carbon market, the project developers, or companies can sell their credits directly to buyers or through a licensed broker. The project developers can also sell their credits to a retailer who can then resell the credits to interested buyers. All voluntary credits must be verified by an independent third party and must adhere to existing standards.

However, currently several exchanges trade in compliance carbon credits and allowances covering spot and futures markets. These include (i) Chicago Mercantile Exchange (ii) CTX Global (iii) European Energy Exchange (iv) Global Carbon Credit Exchange gCCEx (v) Intercontinental Exchange (vi) MexiCO2 (vii) NASDAQ OMX Commodities Europe and (viii) Xpansiv. In fact, many companies now engage in emissions abatement, offsetting, and sequestration programs. These generate credits that can be sold on one of these exchanges. According to World Bank report, compliance market credits account for most of the offset and credit market today. in 2021, trading on the VCM was 300 MtCO2e. By comparison, the compliance carbon market trading volume was 12 GtCO2e and global greenhouse gas emissions in 2019 were 59 GtCO2e.

Unforeseen Bottlenecks

- Integrity of Credits: The process of ensuring that credits represent real and additional reductions i.e. the quantification process can be a daunting task. Myriad of issues ranging from double-counting to over-estimation of the GHG reductions can undermine the system’s effectiveness and robustness.

- Market Volatility: Akin to the cryptocurrency e.g. bitcoin, the price of carbon credits can be highly volatile, making it difficult for businesses to plan for long-term investments in GHG emission reduction. Additionally, weak regulatory frameworks make the credits risky ventures due to future uncertanties.

- Equity Concerns: Some experts argue that carbon credits allow wealthier nations or companies to “buy their way out” of reducing emissions, rather than making substantive changes in promoting environmentally viable projects.

Future of Carbon Credits

The expansion and integration of carbon markets globally and the expansion of sectors covered by these markets are crucial for increasing their impact. In the realm of technology, the technological advancements in carbon capture and storage, as well as more accurate monitoring and verification methods, can enhance the efficacy of carbon credits. The policy developments are also ongoing implying that continued international cooperation and robust policy frameworks are essential for the success and credibility of carbon credit systems. In conclusion, carbon credits are a significant tool in the fight against climate change since they are designed to encourage and reward the reduction of greenhouse gas emissions through a market-based approach. However, their effectiveness relies heavily on rigorous standards, transparent practices, and continuous improvement in regulatory as well as technological frameworks.

Carbon Credits in Kenya

Carbon credits are permits that allow the holder to emit a certain amount of carbon dioxide or other greenhouse gases. One credit equals one ton of CO2. The Credits can be traded on international markets.

As the demand for high integrity, African-originated carbon credits increases, we believe there is a unique opportunity to further leverage carbon markets to address the significant financing gap for climate action in the continent. Even though multiple initiatives are underway to stimulate both the supply and demand for carbon credits in Africa, the region has not yet realized its full carbon market potential. Currently, Africa only generates around 2% (39 million in 2021) of its estimated potential of 2,400 million carbon credits per year.

Kenya was the second largest issuer of carbon credits in the voluntary market in Sub-Saharan Africa in 2022 and is taking further action to position itself as a regional leader by amending its 2016 Climate Change Act in 2023 and finalizing regulations to create the enabling environment for carbon trading in the country. To further promote carbon markets, the World Bank Group and the Kenya Private Sector Alliance (KEPSA) launched the Carbon Market Guidebook for Kenyan Enterprises to bridge the knowledge gap and empower Keyan enterprises to access carbon finance. We hope that, together, these efforts will further bolster Kenya’s position as a dynamic economic hub in East Africa and contribute to global climate mitigation efforts.

Kenya has been active in the carbon credit market, primarily through projects that generate carbon offsets. These projects typically focus on sustainable land use, reforestation, renewable energy, and energy efficiency.

Key Projects and Initiatives

- Reforestation and Afforestation Projects: These involve planting trees in deforested areas or creating new forests. Trees absorb CO2, thereby reducing the amount of greenhouse gas in the atmosphere.

- Renewable Energy Projects: Kenya has invested in wind, solar, and geothermal energy projects. These projects generate clean energy and reduce reliance on fossil fuels.

- Cookstove Projects: Traditional cooking methods often rely on wood or charcoal, leading to deforestation and high carbon emissions. Improved cookstoves are more efficient and reduce emissions.

Benefits of Carbon Credits in Kenya

- Economic Benefits: Selling carbon credits generates revenue for the country and local communities involved in carbon reduction projects.

- Environmental Benefits: Carbon credit projects help in conserving biodiversity, reducing deforestation, and promoting sustainable land management.

- Social Benefits: Projects often include community development components, such as providing jobs and improving local infrastructure.

Challenges and setbacks

- Verification and Monitoring: Ensuring that carbon credits are genuine requires rigorous monitoring and verification.

- Market Volatility: The price of carbon credits can be volatile, affecting the predictability of revenues from these projects.

- Equity and Fair Distribution: Ensuring that the benefits of carbon credit projects reach local communities can be challenging.

Regulatory frameworks

Kenya has established policies and regulations to facilitate the development of carbon credit projects. The government works with international organizations and private entities to promote and manage these initiatives.

Future prospects

Kenya aims to expand its participation in the carbon market by developing more projects and improving the framework for carbon trading. This includes leveraging technology and international partnerships to enhance the effectiveness and reach of carbon credit initiatives.

Credits to: carboncredits.com

Carbon credit it’s among amazing things ever that promote the economic in Africa and in my country East Africa, with more benefits that every Kenyan should learn through planting tree to reduce emissions and still get credit from carbon credit

Very true Nathan! The future is carbon credits and offsets. This will ensure reduction of greenhouse emissions hence lower global warming in long run.